This would allow homeowners to deduct the taxes from their upcoming tax bill. The tax reform bill caps state and local property tax deductions at $10,000.

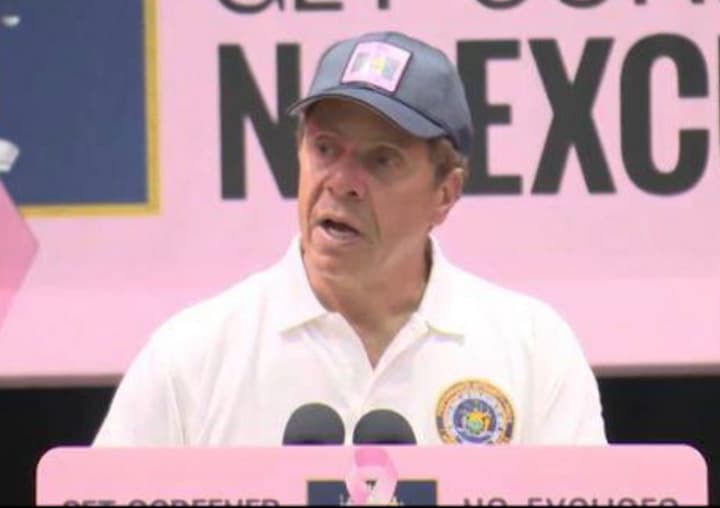

"As Washington wages an all-out assault on this state and this nation, I have authorized local governments to allow property owners to pay part or all of their taxes early," Cuomo said.

Officials should issue warrants for the collection of taxes and deliver them to the local tax collector immediately, and no later than 11:59 p.m. on Thursday, Dec. 28, according to the executive order.

The executive order also suspends local laws limiting the ability of taxpayers to make a partial payment of property taxes until the end of the year. Since many taxpayers do not yet know the exact amount of their bill, this will allow for a portion of taxes to be paid early and under the current federal tax law, according to the executive order.

The Republican-led tax plan was designed to hurt Democratic states and reward Republicans ones, Cuomo said.

“It’s take from the blue to pay red,” he said. “It’s targeted, unequal. It is designed to hurt us long-term from an economic competitive point of view.”

Taxpayers who postmark payments by Dec. 31 will get to take them as a deduction on their 2017 federal tax returns.

“Somebody would have to have the cash on hand to pay by December 31st,” Cuomo said. “It is a viable option. I’m encouraging the local jurisdictions to do whatever they can do to make this possible.”

The executive order will also suspend local laws limiting the ability of taxpayers to make partial payment of property taxes until the end of the year. Since many taxpayers do not yet know the exact amount of their bill, this will allow for a portion of taxes to be paid early and under the current federal tax law.

Each local tax collector is now authorized and directed to accept partial payments of warranted taxes from property owners until the close of business on Friday, Dec. 29. Online payments can be made until 11:59 p.m. on Sunday, Dec. 31, and payments made by mail that are postmarked on or before Dec. 31 are authorized.

You can view the executive order here.

Click here to follow Daily Voice Armonk and receive free news updates.